A graph from the IEA's report WEO 2010 reveals that IEA believes that the world crude oil production (not including NGL or others) has peaked in 2006 or nearby:

Previously, I asked Mr. Fatih Birol, chief economist of IEA in a conference(in 2008) at METU Alumni Association, whether world will see 100 million b/d (current production of crude+ngl+other is hovering around 85-89 mb/d). He briefly described the nuances between crude oil, crude oil+NGL or other associates of crude oil. Then he stated "I don't think so"(for crude oil only). World Energy Outlook 2010 steps further and addresses a peak in crude oil only production as I marked on the graph.

Wikileaks reveal some interesting documents regarding Saudi Production. Sadad Al Husseini retired head of exploration and production for Saudi Aramco, states that Saudi Production can hardly hit 12.5 million b/d and according to documents :

" as he believes that Aramco’s reserves are overstated by as much as 300 billion bbls of “speculative resources.”

the former Aramco board member does believe that a global output plateau will be

reached in the next 5 to 10 years and will last some 15 years, until world oil

production begins to decline." (Wikileaks)

The cable is from December 10, 2007. But there is nothing to confidential about it. Sadad Al Husseini said these things before. He previously to energy bulletin he writes :

"Therefore my answer is: under the current circumstances and outlook, oil is likely to peak at a 95 mmbd plateau by 2015 and can then be sustained well beyond 2020 at increasing real oil prices."(Energy Bulletin)

So are we peaked or are we on the plateou of world oil production? We should better be careful claiming answers to such questions. But it is easier to say that, oil production will suffer from delayed investment. To get a better understanding of oil prices, we should check the storage levels and price trends during the May -driving season-. My personal belief is we are entering another high price cycle unless another economic slowdown happens. It is a risk to write those things openly on the net, since net has a memory. Prices may calm down? I am desperate to see that...

http://www.energybulletin.net/node/9498

http://www.theoildrum.com/node/7102

http://www.wikileaks.ch/cable/2007/12/07RIYADH2441.html

![]()

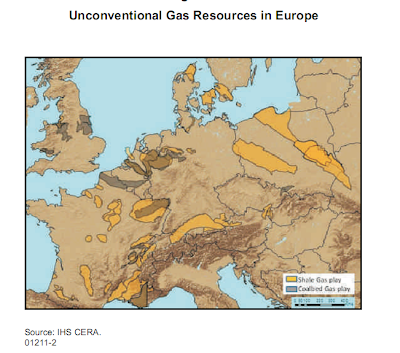

Also, 2010 gas figures can be found:

Also, 2010 gas figures can be found: