IEA's 60 million barrels and US's SPR

5:25 PM

0 Responses

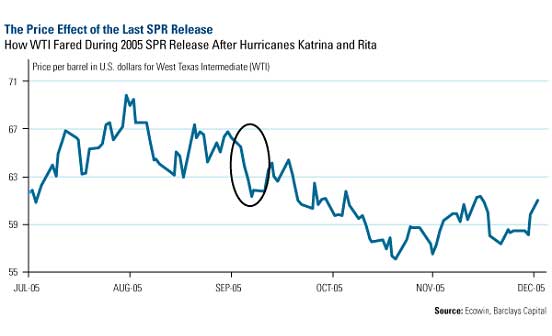

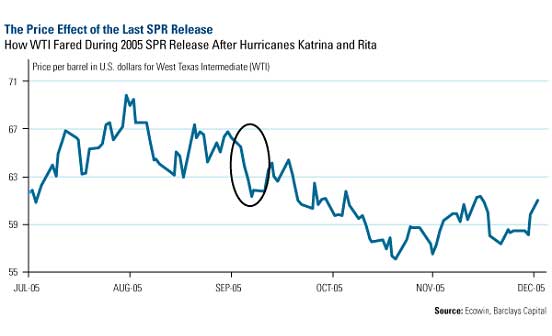

Previous SPR's effect (During Katrina)

On the 23rd June 2011, IEA has decided to release 60million barrels from its 28 members' reserves.

IEA members have 4.1 billion barrels of stocks, some 1.4 billion barrels is for emergency.

They will release 2 million barrels/day for the initial 30 days.

The question is whether this reserves can be traded freely like a normal reserve? Buyers of SPR may not sell it to overseas (Platts)

Ref:

http://www.iea.org/press/pressdetail.asp?PRESS_REL_ID=418

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Oil/6229240

http://321energy.com/editorials/holmes/holmes0062811.html

On the 23rd June 2011, IEA has decided to release 60million barrels from its 28 members' reserves.

IEA members have 4.1 billion barrels of stocks, some 1.4 billion barrels is for emergency.

They will release 2 million barrels/day for the initial 30 days.

The question is whether this reserves can be traded freely like a normal reserve? Buyers of SPR may not sell it to overseas (Platts)

- "The auction for 30 million barrels of light sweet crude starts at 1 p.m. CDT on Wednesday, with deliveries occurring between August 1-31."

- ""No, you cannot sell to Latin America or China," DOE said in an explainer posted to its website. "SPR petroleum may be exported only with an export license and in connection with the return of refined products to the US.""

- "The US share [30 million barrels] represents 4% of its current stockpile of 727 million barrels"

- U.S. holds (56 percent) while Japan (24 percent), Europe (14 percent) and Korea (6 percent) of the SPRs.(321 energy)

Ref:

http://www.iea.org/press/pressdetail.asp?PRESS_REL_ID=418

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Oil/6229240

http://321energy.com/editorials/holmes/holmes0062811.html

Read more...

oil

|