Me, listening Russian:)

Read more...

China's economy grew at an annualized 6.1 percent rate in the first quarter, and

7.9 percent in the second. Yet electricity usage, a key indicator in industrial

growth and a harder metric to manipulate, declined 2.2 percent in the first six

months of the year.

A professor fed up with his wife's phone beeping for low battery came up with this idea, which is not very complex. It is charging by induction I guess. But there is a video and pdf file to see.

A professor fed up with his wife's phone beeping for low battery came up with this idea, which is not very complex. It is charging by induction I guess. But there is a video and pdf file to see.

"a website that describes itself as a place "where people meet to lend and borrow money … sidestepping the banks". The idea is pretty simple. Someone who has money to spare goes online, says how much he's ready to lend and at what rate of interest – and waits for would-be borrowers to take him up on his offer. If both sides are happy – and Zopa stands for the negotiating term "zone of possible agreement" – then the deal goes ahead. Quite a few of them, as it happens: Zopa has now facilitated £50m worth of loans, from one ordinary Briton to another"

Reason? Quite simple according to article : " it turns out that nine of those banks who between them trousered $175bn of the American public's money in bailout funds – have fallen back into their old habits: last year they paid their top staff $32.6bn in bonuses."

"Generally, the declines in demand and prices are the most precipitous and most sustained seen in the United States since the 1950s."

Ref:

Also new section, called “The Energy Imperative,” outlines the need for an integrated set of solutions that includes improved energy efficiency, development of all economically viable energy sources, and cost-effective steps to curb emissions

"The deposits on the North Slope of Alaska are among the richest. A 2008 USGS study showed that there are 2.4 trillion cubic metres "

Worth a look!

The oil price surge that started in 2003 and collapsed in 2008 had its

roots in 1998. ....

What action is required?

- A regularly updated listing of all future oil and natural-gas-liquids (NGL)

projects.- Future capacity costs.

- Proven reserves categorization.

Creating an institution to house such a process is

the best way to begin to deal with the oil-supply challenges that must surely

lie ahead.Ref: JPT Online, http://www.spe.org/jpt/print/2009/08/7GuestEditorial.pdf

Check:

http://www.millennium-institute.org/resources/elibrary/index.html#models

Some very useful info from Dr. Michael Dittmar @ The Oil Drum:

Also:

assume that each nuclear weapon contains on average just the critical mass or at

least 50 kg of U235. Using this assumption, we find that the U235 of one nuclear

bomb corresponds to 7 tons of natural uranium equivalent on average, and that

the uranium from about 25 such bombs is sufficient to operate a 1 GWe reactor for one year

There is a very good presentation by Matt Simmons arguing the bad side of cheap oil. The low prices keeps the investments at low levels. Therefore the seeds of another oil shock will be planted soon, if prices do not climb to acceptable levels.

There is a very good presentation by Matt Simmons arguing the bad side of cheap oil. The low prices keeps the investments at low levels. Therefore the seeds of another oil shock will be planted soon, if prices do not climb to acceptable levels.

This version of the report starts with the criticization of IEA numbers, especially China. Crude Oil production is down by nearly 3 million barrels (not world liquid production). Check the oil demand of OPEC countries! There is a big drop in their demand as well. Also, have a look to the Mexico, UK and Norway.

Report is available here (Peakoil.nl)

Report for 30 March 2009.

Report for 30 March 2009.You can also access the interactive web page from here .or here.

From the page, you can select from various parameters and see the latest data. It is limited to US however it gives a good activity about oil in the world's biggest consumer. On the date I checked it, gas activity was higher than oil activity.

Model can be downloaded from here and documentation is here. In the document you can find the relevant informations about using the files.

"The World Energy Projection System (WEPS) was developed by the Office of Integrated Analysis and Forecasting within the Energy Information Administration (EIA), the independent statistical and analytical agency of the U.S. Department of Energy. WEPS is an integrated set of personal computer-based spreadsheets containing data compilations, assumption specifications, descriptive analysis procedures, and projection models. The WEPS accounting framework incorporates projections from independently documented models and assumptions about the future energy intensity of economic activity (ratios of total energy consumption divided by gross domestic product [GDP]), and about the rate of incremental energy requirements met by natural gas, coal, and renewable energy sources (hydroelectricity, geothermal, solar, wind, biomass, and other renewable resources). Projections produced by WEPS are published in the annual report, International Energy Outlook."

They also have a demo page for you to see what other things is possible with the starter kit. You can compare per person consumption, between different buildings and etc. 5 stars

WSJ : China Takes Aim at Dollar

Chinese Central Bank : Reform the International Monetary System

Then check this one:

Then check this one:

My conclusions:

1 - Crude and square of euro/dollar parity is in harmony

2 - Recession started hitting by the end of september 2008

3 - Crude and gold relation is broken for sometime

4 - Observe the euro's appreciation against dollar and rise in crude prices

All this means is crude prices will rise, since dollar will lose some of its value. By the end of May 2009, there is a great possibility that we may see 65-70 $ if dollar continues its slow depreciation. May is the start of driving season.

According to Wang Qian, a Hong Kong-based economist at JPMorgan Chase & Co. :

According to Wang Qian, a Hong Kong-based economist at JPMorgan Chase & Co. : You can download the report from here. Following excerpts are from the intro:

You can download the report from here. Following excerpts are from the intro:"More recent figures from the Energy Information Administration show that crude oil stocks in the USA increased from 334 million barrels in January to 350 million barrels in February, a level not seen since the beginning of the 1990s. On top of the commercial stocks on land the 50 to 80 million barrels of floating storage in oil tankers on the seas still remain."

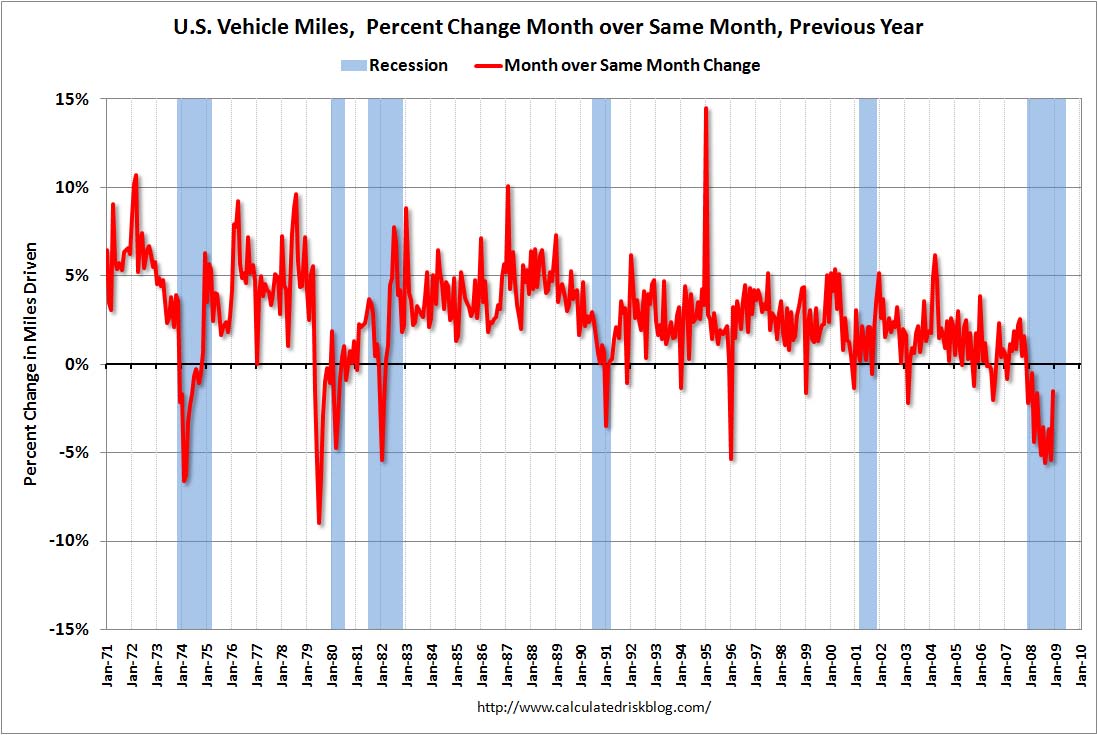

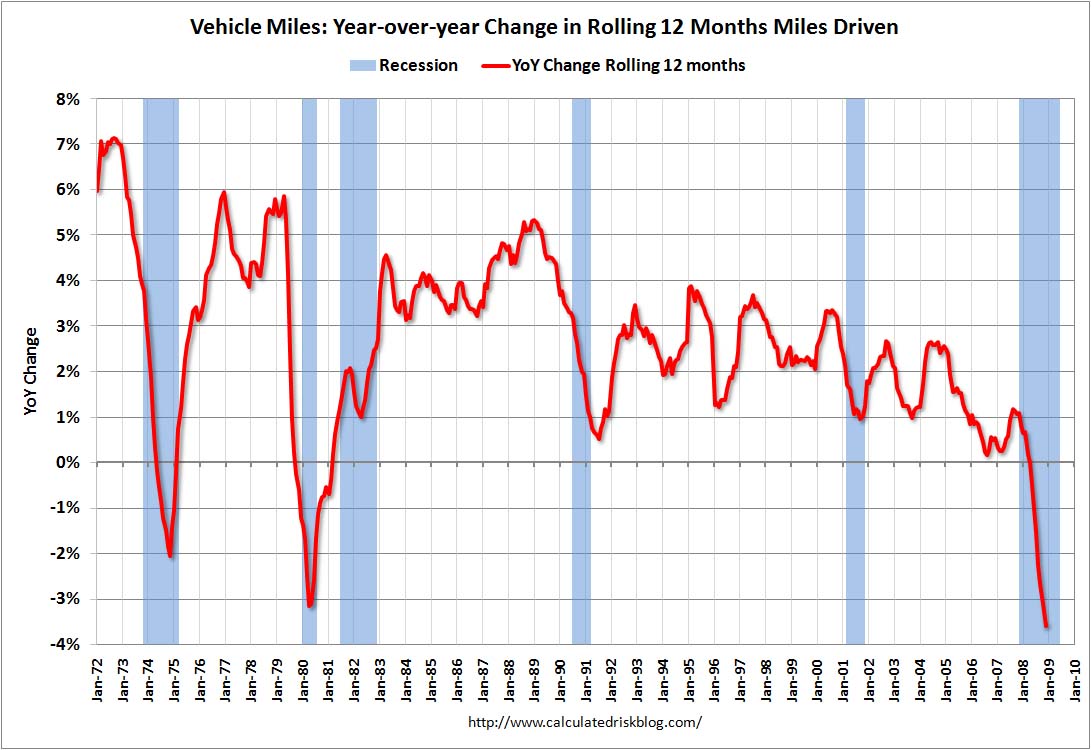

Also check this graph, for general driver behaviour:

Also check this graph, for general driver behaviour:

And electricity demand is as follows

And electricity demand is as follows

Turkish electricity consumptions by sectors can be reached from TEDAS website. The latest year is 2007

Turkish electricity consumptions by sectors can be reached from TEDAS website. The latest year is 2007

A simple regression of log GDP on a time trend and lagged log GDP, over the 1967q1-08q4 period yields the following:

yt = 0.424+0.0004time + 0.945yt-1Where Adj-R2 = 0.9995, SER = 0.008

The AR1 coefficient of 0.945 (se = 0.03) implies a half life of 12.25 quarters, or slightly over 3 years for a deviation from output. Since AR coefficients are biased downward, this is a downwardly biased estimate of the half life.