If you are one those experts that do not submit yourself to international climate change groups and have enough knowledge to built your own scenarious, there is tool that can help you.

It is free of charge, just press download in the following site, and submit the form, then you will be directed to a page to download one big chunk of model and files. (Size: 160 MB). The name of the program is Magicc/Scengen. It does all sorts of things. Web page is at the end of this post.

The following information is from the

website: "MAGICC consists of a suite of coupled gas-cycle, climate and ice-melt models integrated into a single software package. The software allows the user to determine changes in greenhouse-gas concentrations, global-mean surface air temperature, and sea level resulting from anthropogenic emissions"

MAGICC/SCENGEN Overview:

MAGICC and SCENGEN are coupled, user-friendly interactive software suites that allow users to investigate future climate change and its uncertainties at both the global-mean and regional levels. MAGICC carries through calculations at the global-mean level using the same upwelling-diffusion, energy-balance climate model that has been and is employed by IPCC. SCENGEN uses these results, together with spatially detailed results from the CMIP3/AR4 archive of AOGCMs, to produce spatially detailed information on future changes in temperature, precipitation and MSLP, changes in their variability, and a range of other statistics.

In running MAGICC/SCENGEN, the user can intervene in the design of the global or regional climate change scenario in the following ways:

By selecting and/or specifying the greenhouse gas and sulfur dioxide emissions scenarios.

By defining the values for a limited set of climate model parameters in MAGICC that are important in determining the effects of uncertainties in the carbon cycle, the magnitude of aerosol forcing, the overall sensitivity of the climate system to external forcing, and ocean mixing rate.

By specifying the future time period for which results are displayed (out to 2400).

By specifying the AOGCMs that are averaged to produce the climate change pattern information.

By selecting an area or region for spatial averaging of climate change results.

This version of MAGICC/SCENGEN was developed primarily with funding from the U.S. Environmental Protection Agency, but it rests on developments carried out over the past 20 years that were funded by a number of organizations.

Download from here:

Report for 30 March 2009.

Report for 30 March 2009.

Then check this one:

Then check this one:

According to Wang Qian, a Hong Kong-based economist at JPMorgan Chase & Co. :

According to Wang Qian, a Hong Kong-based economist at JPMorgan Chase & Co. : You can download the report from

You can download the report from

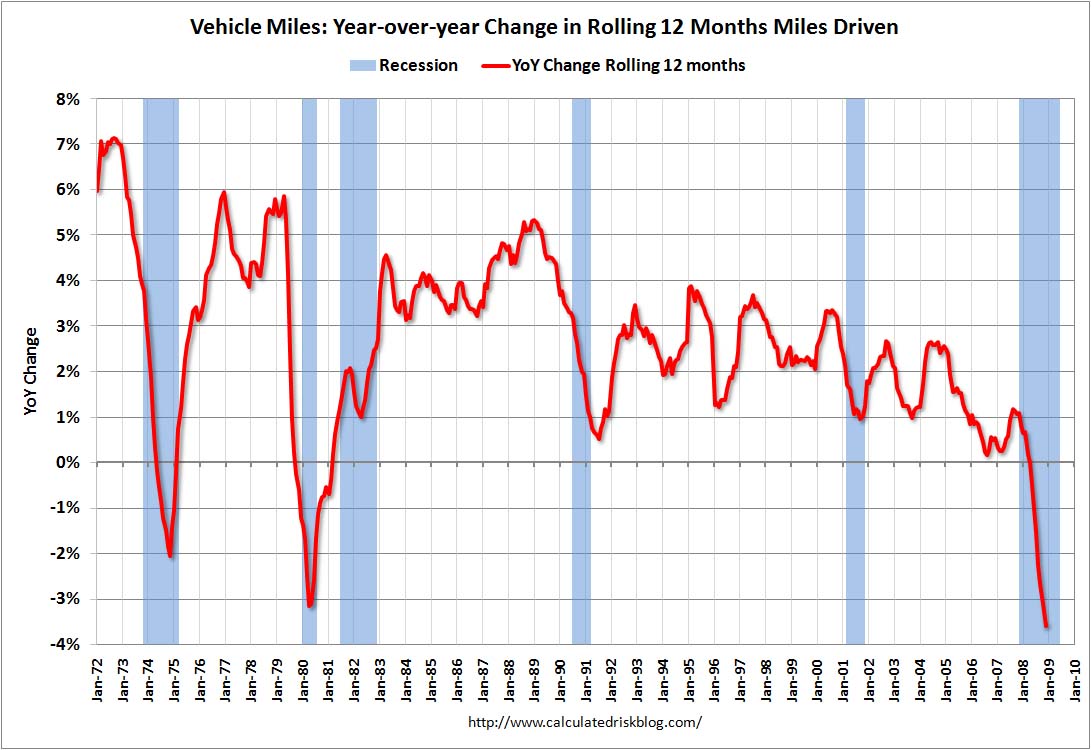

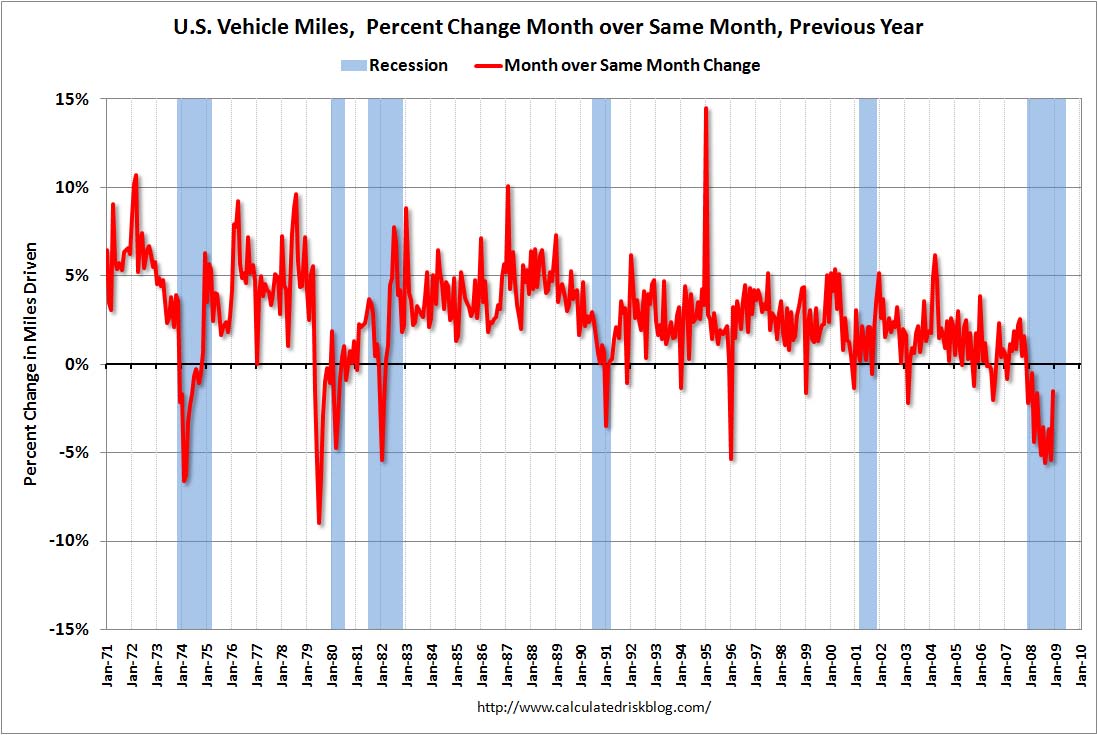

Also check this graph, for general driver behaviour:

Also check this graph, for general driver behaviour: